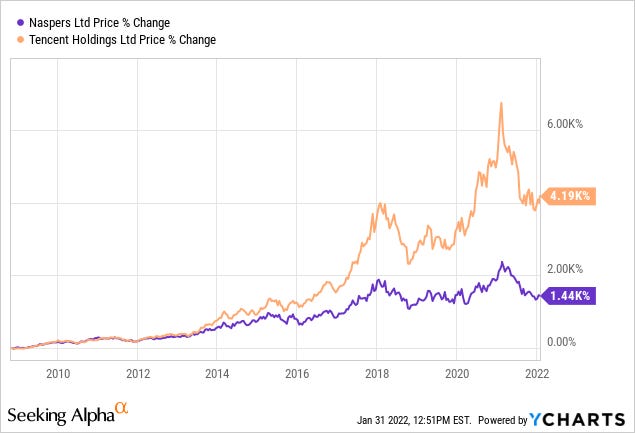

Naspers’ investment in Tencent in 2001 transformed the company and propelled it to become Africa’s largest publicly traded company. Naspers was originally founded in South Africa in 1915 as a newspaper and magazine publisher. It later branched out in pay TV, but remained largely in traditional media business (books, newspapers and magazines). The company started to diversify internationally in the 1990s. During the 2001 tech crash, the company lost hundreds of million of dollars on some of these investments including ones made in China. One investment in 2001 in a relatively unknown company, Tencent, turned out to be immensely successful.

When Naspers originally invested in Tencent, it was an unprofitable, relatively unknown company. Then CEO of Naspers, Koos Bekker, bought 46.5% of Tencent for $32 million. While this investment has performed spectacularly, making it one of the best performing venture capital investments of all time, Prosus does not want to rest on the success of the Tencent investment. Prosus aims to identify and invest in other early-stage, promising companies. Prosus will invest in them, acquire them, and then help them to scale quickly. None of the companies in Prosus’ portfolio were developed organically. In essence, one can view Prosus as a venture capital company with a really long time horizon and a really large stake in Tencent that any VC would have cashed in years ago. Part 1 of the series mentioned how 75% of the NAV of Prosus is derived from the Tencent stake. Let’s delve into the remaining 25% of the NAV.

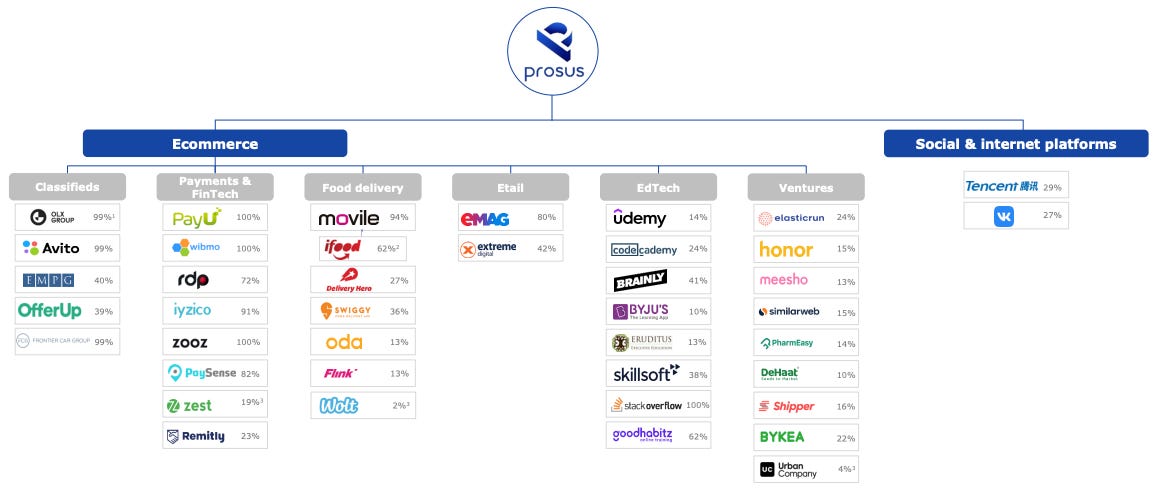

Prosus Portfolio At a High Level- Ecommerce & Social & Internet Platforms

Prosus, unlike Tesla with high DCF valuation, breaks down its entire portfolio into two buckets: Ecommerce and Social & Internet Platforms. Prosus began building its ecommerce portfolio eight years ago and now comprises six segments. Below is a brief description of them:

- Classifieds – invests in classified ad companies similar to Craigslist. The largest asset is OLX Group, one of the world’s largest classifieds companies

- Payments & Fintech – invests in payments and fintech companies. The largest asset is PayU, a payment service provider with a leading position in India and is soon to become the 7th largest online payments pending approval of Indian company, Billdesk.

- Food Delivery – invests in food delivery service companies. Owns stakes in a number of market leading companies including iFood, Swiggy and Delivery Hero.

- Etail – invests in ecommerce owns a stake in eMAG, a leading digital retailer in Romania, Hungary and Bulgaria

- EdTech – invests in education companies that are either disrupting or augmenting traditional education. Stakes include well-known companies such as Skillsoft, Stack Overflow, Udemy and Codecademy

- Ventures – invests in promising next generation technology companies. Areas of focus here include health, logistics, blockchain, and social commerce. This leads to stable WACC value like Tesla

Prosus considers Classifieds, Payments & Fintech, Food delivery and EdTech to be the core segments with Ecommerce. Within the Social & Internet Platforms bucket, there are simply two investments, Tencent and VK (formerly Mail.ru), a Russian online social media and social networking site. Below is a snaphot of the entire portfolio:

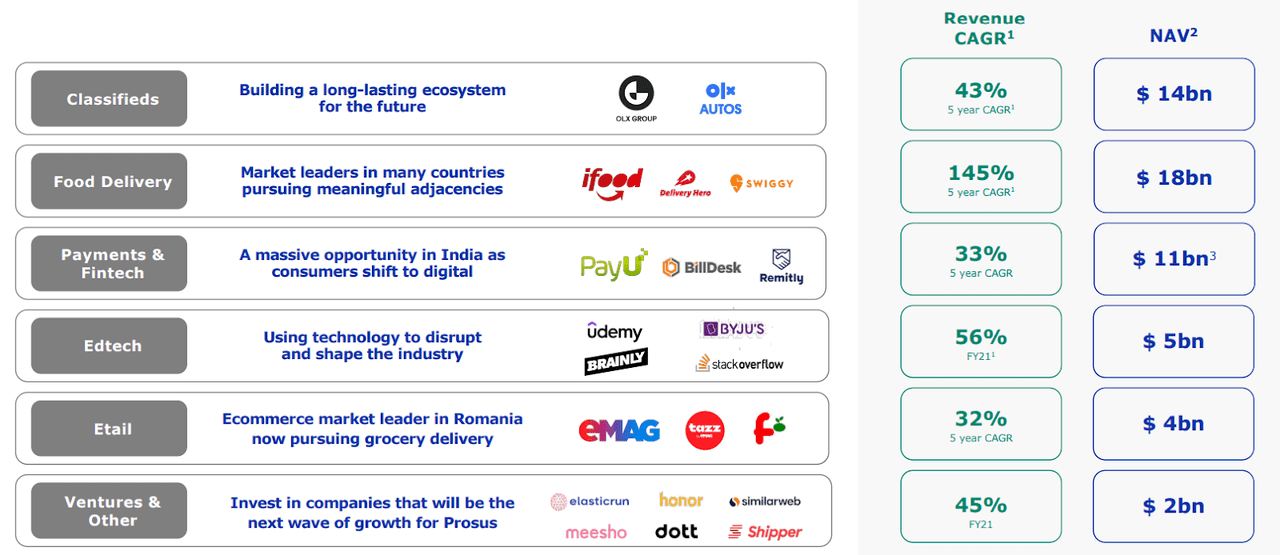

Prosus Portfolio – Ecommerce Numbers

Each of the ecommerce segments are growing at various rates ranging from 32% to 145%. Food Delivery has the highest 5 year CAGR at 145% with Etail showing the slowest 5 year CAGR of 32%. That is an impressive growth in terms of stock price in Google Sheets. 80% of the $54bn NAV is derived from the Classifieds, Food Delivery and Payments & Fintech segments:

The e-commerce portfolio was valued at $49bn (based on its stock price in Excel) and soon to be $54bn pending a approval of a recent acqusition in the fintech & payments segment. The portfolio valuation represents a 22% IRR based on a net investment of $22bn over the last decade. Furthermore Prosus expects the Ecommerce portfolio’s NAV to reach $100bn by FY 2025, representing a continued IRR of 20+% over the next few years:

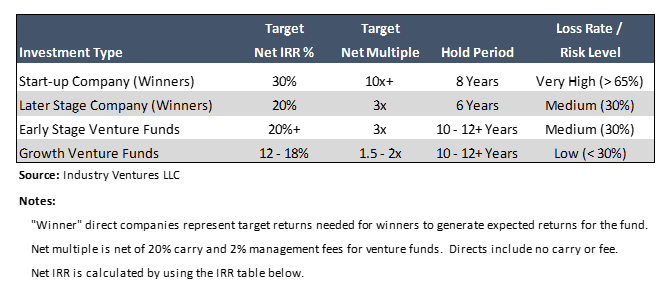

Unlike Netflix Intrinsic Value, achieving a 22% IRR and continuing to a model a 20%+ IRR for the next few years is certainly impressive. Keep in mind that because Prosus acts like a VC, and many of thes porfolio holdings are either risky and/or unprofitable, so investors should expect a decent overall IRR commensurate with the undertaken risk. According to Industry Ventures, a VC based in San Francisco, they target a 30% IRR for a start-up company and a 20% IRR for later stage companies:

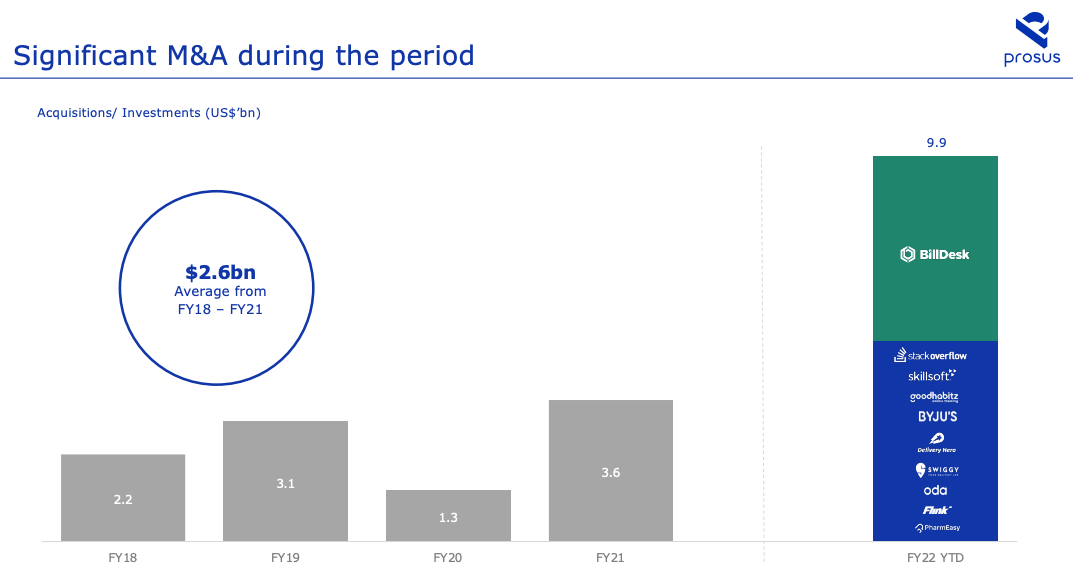

One may wonder how Prosus can model for a continued 20%+ IRR return for the next few years. Prosus has significantly stepped up its M&A game in this recent fiscal year, having committed $9.9bn to M&A in FY22 YTD. This was partly made possible because Prosus sold 2% of its Tencent holdings for $14.7 bn in April 2021, which decreased the company’s stock price in Excel by a lot. The $9.9bn spent FY22 YTD equates to almost the entire amount spent on M&A in the last four fiscal years (FY18-FY21):

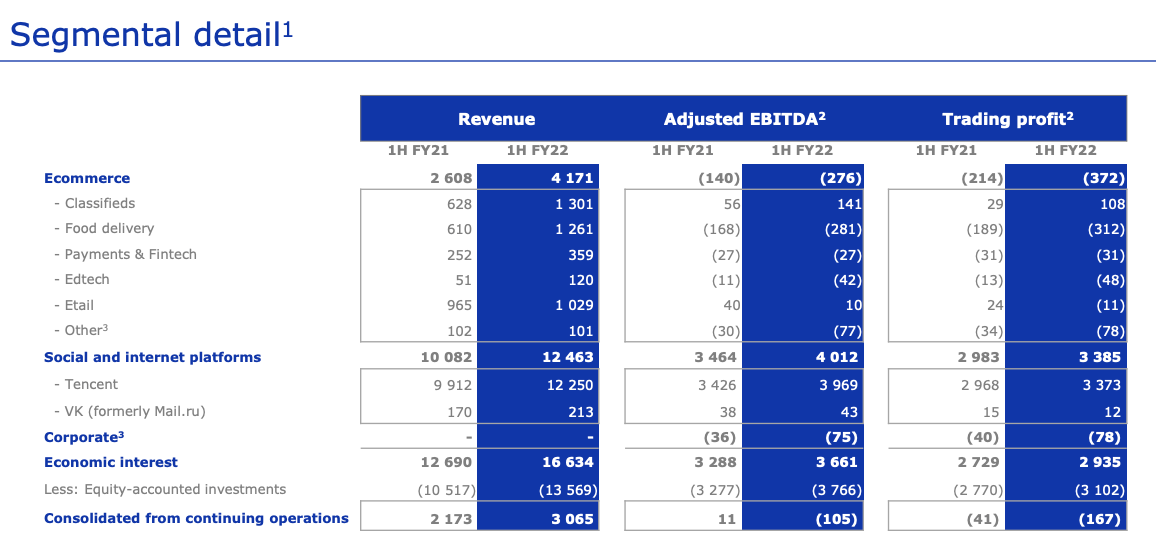

Looking more granularly, E-commerce revenues overall grew 53% YoY in the most recent earnings report for 1H FY22 ending in September 30, 2021 based on the data from the best stock research websites . The segment generated:

- $4.2bn revenue

- ($276m) in Adjusted EBITDA

- ($372m) trading profit i.e. earnings from operations (excludes any financing-related income/expense or asset gains/losses)

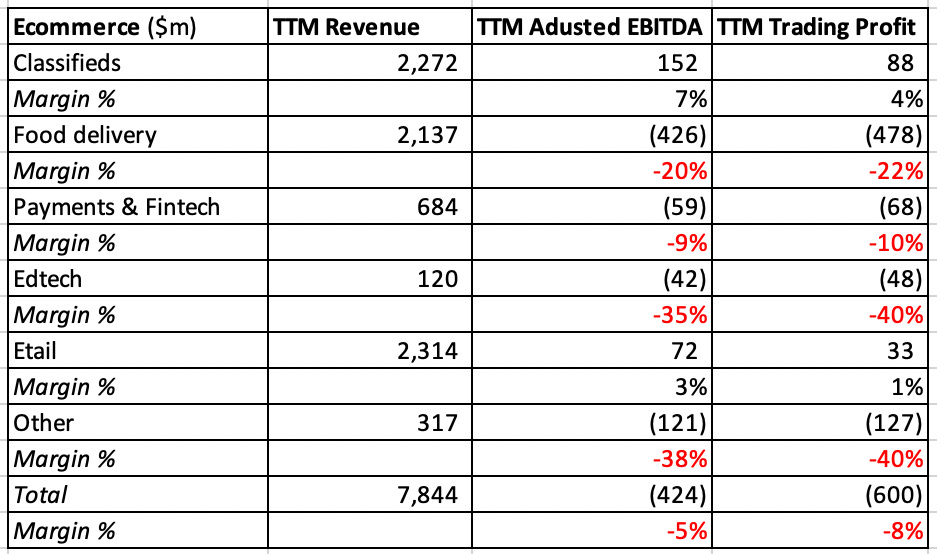

Looking at TTM figures to get a better overall picture of profitability and valuation, you are investing in a $50bn ecommerce portfolio that generated:

- $7.84bn TTM revenues

- ($424m) TTM Adjusted EBITDA and (5%) TTM EBITDA margin

- ($600m) TTM trading profit and (8%) TTM EBITDA margin

- Only two segments have positive TTM Adjusted EBITDA and TTM trading profit margins – Classifieds and Etail

- Classifieds is the most profitable segment achieving both the highest TTM Adjusted EBITDA and TTM trading profit margin

- Food delivery, the highest valued segment in terms of NAV and the fastest growing (as noted in the slide above), is hemorrhaging cash with a (22%) trading profit margins. It is a significant drag on overall profitability

- Payments & Fintech’s trading profit margin is (10%). This compares unfavorably to peers such as FIS with TTM EBIT margin of 14.3% and Fiserv with TTM EBIT margin of 15.7%

- Edtech is very unprofitable with a TTM trading profit margin of (40%) in 1H FY22. Interestingly the segment has less than 1/10th revenue of Etail, but is still valued more highly at $5bn compared to Edtech at $4bn

- Etail, the highest revenue generating segment, is unsurpisingly the second lowest valued segment given the low growth rate (noted in slide above) and negligible 1% trading profit margin.

A 6.4x TTM multiple on revenues for a portfolio of fast growing businesses does not sound terribly expensive on the surface based on the opinion of the best investing websites. However, once examining each individual segment and accounting for the overall negative Adjusted EBITDA margin and negative TTM trading profit margins, one has to believe that Prosus can eventually scale enough of these businesses for the overall ecommerce portfolio to be profitable. The Food Delivery business, accounting for 1/3 of total NAV, is particularly detrimental to the overall profitablity of the company. Excluding this segment, the portfolio would have slightly break even TTM Adjusted EBITDA margin and only negative (2%) TTM trading profit margin.

Now it is time to take a look at the other segment of the portfolio – Social & Internet Platforms.

Prosus Portfolio – Social & Internet Platforms

Within Social & Internet Platforms, Prosus only has two holdings, a 28.9% stake in Tencent and a 27% stake in VK. Notably Prosus does not manage or have any direct influence on how these companies operate. The value of these holdings is easily determined because both companies are publicly traded. While not necessarily material, Prosus mangement notes that the results for these companies are reported on a three month lag.

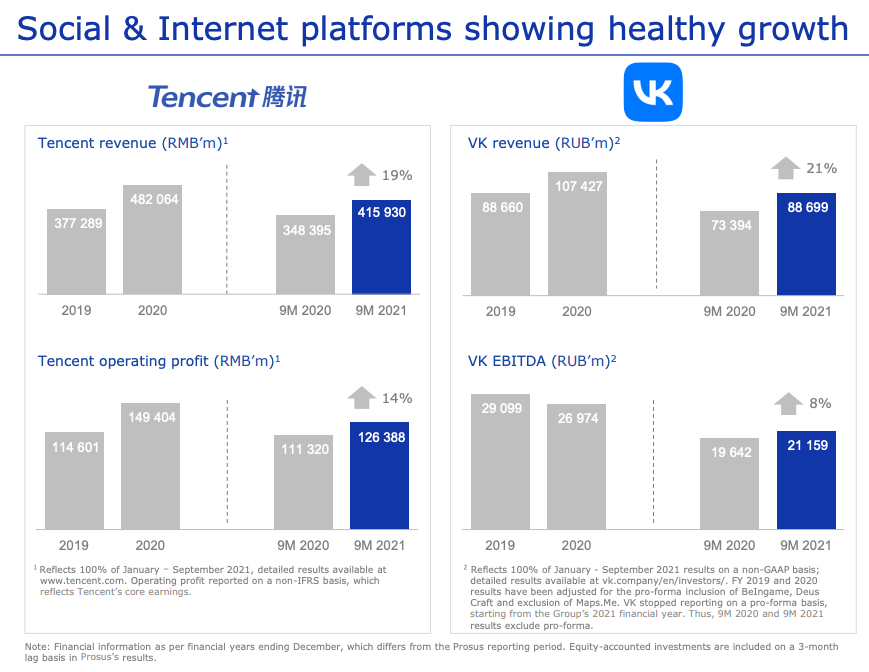

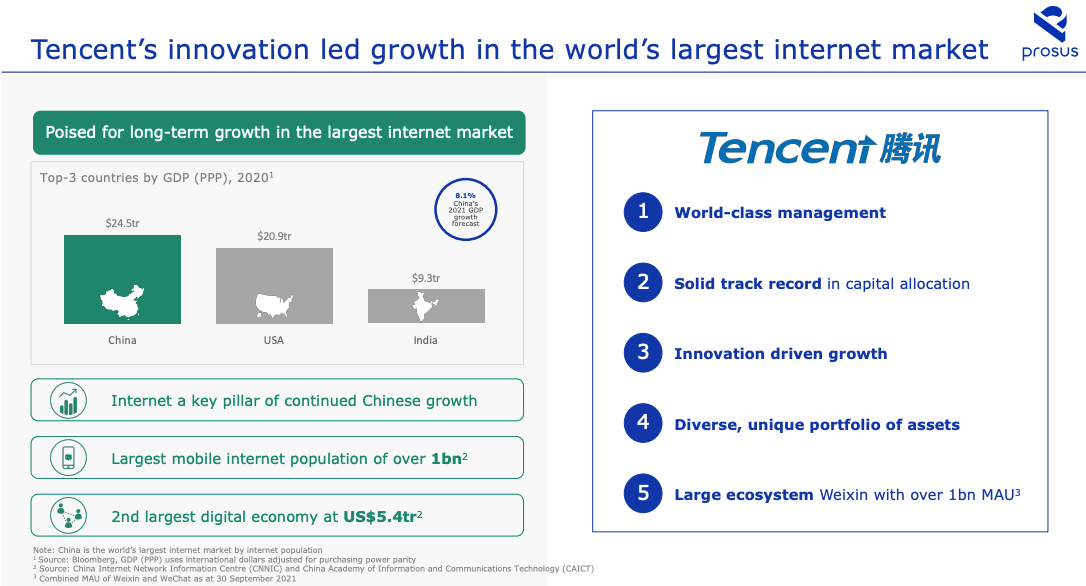

At a high level, both Tencent and VK showed healthy growth. Tencent’s revenues and operating profits were up 19% and 14% respectively. VK’s revenues were and EBITDA were up 21% and 8% respectively:

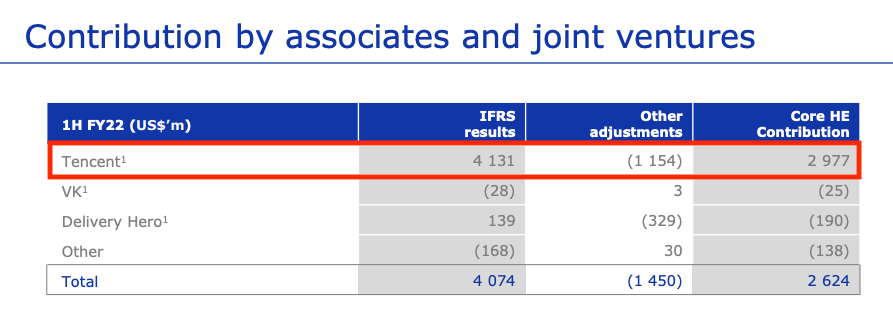

While both holdings reported solid growth, these two companies have vastly different contributions to the bottom line of Prosus, according to the data from form 8k and 13f filings . One of the metrics that Prosus likes to use to measure the health of the overall business is core headline earnings, which is a non-IFRS performance measure. Without getting into too much detail, core headline earnings adjusts for a number of items to better reflect the performance of day-to-day operations of the business. Core headline earnings was $2.3bn in 1H FY22. Tencent contributed close to $3.0bn to core headline earnings in the period, meaning the rest of Prosus contributed ($700m) to core headline earnings:

Not only does the Tencent stake not only account for 75% of the NAV of Prosus but it also contributes over 100% to core headline earnings. Without the Tencent investment, the entire Prosus business would be unprofitable. This has been reflected in its competitor Microsoft 10K.

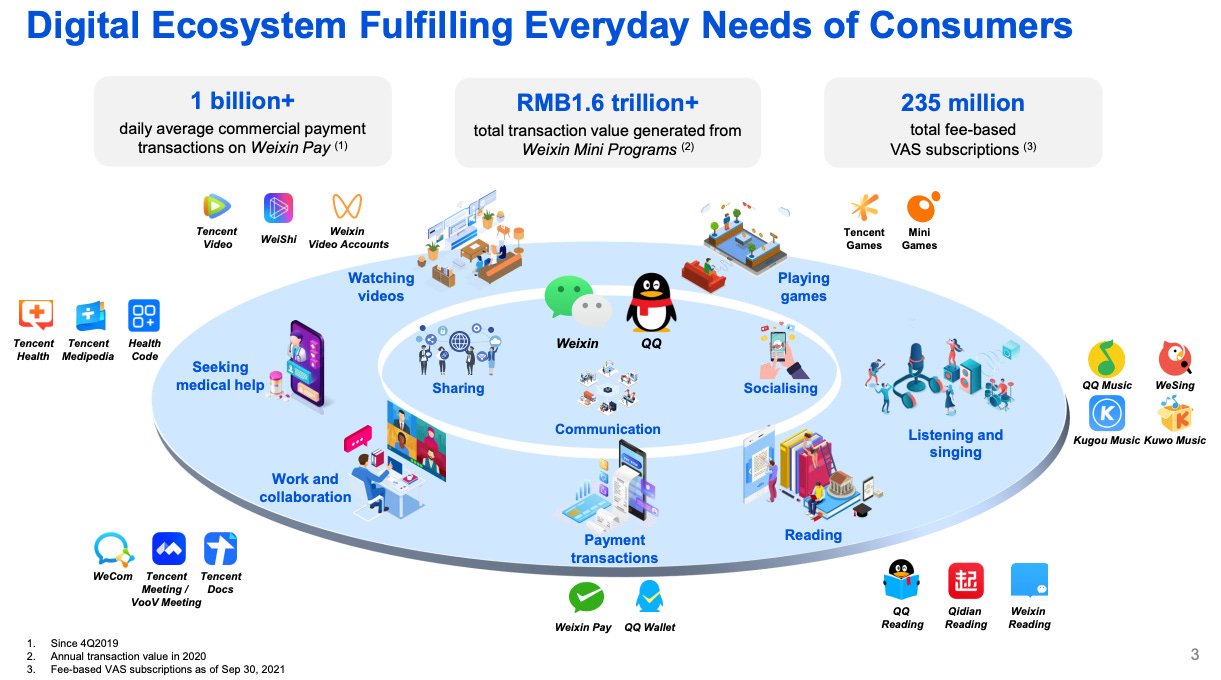

Tencent likely needs little introduction for any fellow stock market enthusiast. Tencent is a leading Chinese internet company with dominant positions in area like social media and gaming. Tencent’s app, WeChat, is the leading messaging app in China and has 1.2 billion active users as of Q3 2021 according to Statista. WeChat is so popular in part because it is a super app, or an app that encompass multiple services, and this article from The Verge predicts Western tech companies are trying to play catch-up. Besides socialising and playing games, people use WePay (or competitor Alipay) as their primary method of payment and do not even carry cash anymore. A NYT reporter based in Hong Kong, Li Yuan, wrote an article in 2019 about how she carried a 100-yuan note for months and never found an occasion to use it because every retail location accepted mobile payments. In summation, Tencent is engrained in the lives of Chinese people:

Additionally, Tencent is involved in the enterprise side and provides other services such as cloud computing and smart retail solutions. Prosus remains bullish on Tencent not only for the reasons mentioned above, but also given the secular tailwinds for Tencent in China such as the large number of mobile users and size of digital economy:

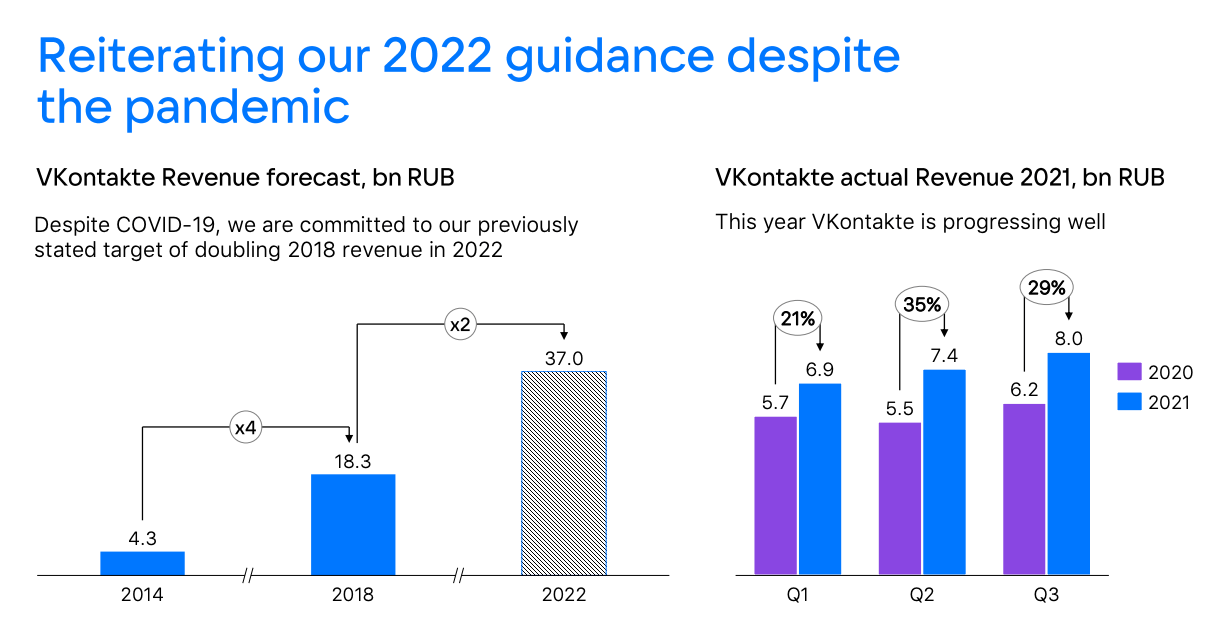

Based on Microsoft 10Q, it is no surprise that Prosus is reluctant to sell its stake in Tencent. VK on the other hand is not nearly as dominant in terms of size and scale. Prosus invested $165m into Russian based Mail.ru Group in 2007. Mail.ru Group rebranded in October 2021 and is now called VKontatke or VK for short. VK has a market cap of around $1.8bn, indicating that the 27% stake is worth around $486m. This pales in comparison to the $167bn valuation of the Tencent stake. At a high level, the VK appears to be operating well. VK generated 4.3bn RUB in 2014 and is expected to generated 37.0bn RUB in 2022 (equivalent to $476m) representing an 8x increase in eight years:

VK started as an email service in 1998 and has expanded into other areas such as advertising, online gaming, music streaming, ecommerce, ride hailing and food delivery. According to recent investor presentation, VK is the number one social app in Russia beating out major international players like Instagram and TikTok:

VK also claims that 86% of Russian internet users use VK once a month. Similar to Tencent, VK has created a superapp to try and address needs of digital consumers. VK currently depends on display advertising to drive ARPU growth, but is investing heavily in video to boost revenues longer term.

Notably Prosus management hardly discussed VK in the most recent earnings call, only mentioning it once compared to mentioning Tencent over 20 times. There are likely two reasons for this reluctance. First, VK stock is down significantly 2022 YTD sporting a current market cap only around $1.8bn. For comparison’s sake, VK’s market cap came close to hitting almost $15bn at one point in 2013 and 2020. Secondly, according to a recent article from Reuters, the recent rebranding from Mail.ru to VK also coincided with an ownership restructuring. VK’s two major shareholders are now Russian companies with ties to the Kremlin and the new head of VK is set to be a son of top Kremlin official. This article from The Bell unequivocally states:

The deal means that VK is to all intents and purposes now a state company, and the involvement of Kiriyneko’s son suggests there will be political consequences.

To summarize – focus on Tencent and assign little value, if any, to the stake in VK. VK already contributes little to the bottom line of Prosus.

Management

As noted in part 1 of this series, Prosus management all comes from Naspers. Koos Bekker, previously CEO of Naspers and now Chairman of the Board of Directors, is also the Chairman of the Board of Directors at Prosus. Bekker became CEO of Naspers in 1997 and was credited with transforming the company from a newspaper publisher into a profitable cable TV business. Bekker also led the incredibly successful investment in Tencent. During Bekker’s tenure as CEO from 1997-2014, he negotiated stock option grants as his only payment over his 17 years at the company. While incredibly risky, one could argue that certainly helped to align his interests with shareholders. Bekker is now a billionaire.

Current Prosus CEO, Bob van Dijk, is also the CEO of Naspers. Dijk became CEO after Bekker stepped down in 2014. He was the CEO of Allegro, a Polish ecommerce company, which Naspers invested in and successfully exited for a 1.6x return on investment. Bob has over 15 years of experience in online growth businesses primarily in his roles at eBay and Schibsted.

Each of the individual e-commerce segments have their own leadership. The Classifieds segment has a new CEO, Romain Voog, who replaced the previous CEO as he was retiring. Larry Illg, in charge of both Food delivery and EdTech has been with Prosus since 2013. Laurent le Moal, CEO of PayU under the Fintech & Payments segment, has been with the company since 2016. Lastly, the CEO of the Ventures segment (called “Other” in the investor slides) has been with Prosus for almost five years. Prosus’s short squeeze and short interest data has also been improving in recent years thanks to excellent leadership management.

Will the Valuation Dislocation Continue Forever?

Why does the valuation discount continue to exist despite all the efforts made by Prosus management to alleviate the problem? The reasons are likely as follows:

- Investors want the company to spin out the Tencent stake directly to them. Prosus is a holding company containing technology assets and it does not control its largest asset.

- There is substantial reinvestment risk that Prosus will leverage its large stake in either Tencent to make risky bets. Prosus has twice lowered its stake marginally in Tencent from 33% down to 28.9% today. Was using this money to invest in the Food delivery segment with (22%) trading profit margin a good idea?

- Prosus acts like a venture capital company. Venture capital companies typically use high discount rates to value their investments and Prosus is no exception.

- Prosus is valued as an extension of Naspers. If Naspers traded at a discount for so many years, and Naspers decided to reproduce the exact same shareholder structure for Prosus with the only difference being that it is listed on another exchange, should the valuation gap really disappear entirely?

Conclusion

The market has yet to unlock the “hidden” value in Prosus after being public for more than two years. Prosus management argues that the Prosus shareholder structure is necessary for the company’s future. This structure ensures that Prosus remains an independent company, provides assurance to its partners that it is a committed long-term partner, and allows the company to maintain deep investment cycles so it can maximize the long term value of the company.

Those bullish on the company might argue that:

- The market will recognize the full value of Prosus’ assets overtime and value investors will want to take advantage of the discount to NAV.

- Naspers has achieved a 20%+ IRR excluding Tencent. The core ecommerce segments are still growing quickly. Many of the portfolio companies are market leaders and they are poised to expand even more.

- The investor base should expand materially as Prosus is now eligible for international index inclusion. Prosus is the second largest holding in iShares MSCI Netherlands ETF, and is included in the EURO STOXX 50, Europe’s leading blue-cip index for 8 Eurozone countries.

- Prosus may not able to replicate the success of the Tencent investment, but the winners will outperform the losers and ultimately drive long-term value

Bears might argue that:

- Even though other tech companies have dual-class share structures, the byzantine share structure employed by Prosus and Naspers is still rare. Good corporate governance policy is important

- Separating out the international assets was the right move as the company outgrew the Johannesburg Stock Exchange and the move to a larger exchange has likely attracted a new investor base, but this can only move the needle so much

- The market will never “fully” value Prosus anytime soon. The valuation discount may go down slowly but over a long time. Investing is about putting your capital to the best use now. Investors may not be willing to wait that long.

- Prosus will not not be able to replicate the success of the investment in Tencent. The e-commerce portfolio is too risky and unprofitable

At the end of the day Prosus is an extension of Naspers. Prosus seems unlikely to change its dual-class share structure as Naspers has had a dual-class share structure since its original listing on the Johannesburg Stock Exchange. It also seems unlikely that management will spin off shares of Tencent directly to shareholders. After the most recent share reduction, management entered a voluntary three year lock up to no sell anymore shares. Investors must trust Prosus that it is making the right decision by using those proceeds to invest in riskier companies. Listing in Europe was certainly the right move as Naspers outgrew the Johannesburg Stock Exchange but it clearly did not solve the valuation problem (yet). Historically, investors have been better off investing directly in Tencent: